Online fraud in India is rising at an alarming pace—especially scams involving fake support calls, screen-sharing tricks, and social-engineering pressure. To counter this, Google has rolled out a major upgrade to its In-Call Protection feature on Android, giving users a stronger digital shield than ever before.

The new system is designed to intervene at the exact moment scammers strike—when a user opens a financial app during a suspicious call. Google says the feature is already proving remarkably effective in stopping fraud attempts globally.

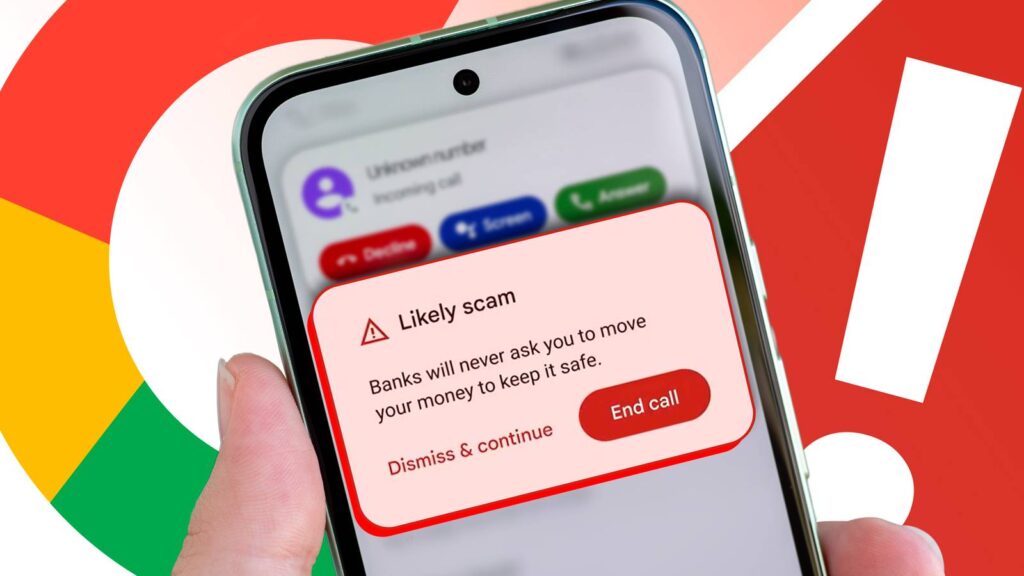

Real-Time Warning When You Open Financial Apps During a Call

If a user is on a call with an unknown number and opens sensitive apps such as UPI, net banking or digital wallets, a full-screen alert will immediately pop up.

The alert warns:

“This call may be a scam. Consider disconnecting.”

Users will also get the option to end the call instantly, breaking the manipulative script scammers often use to confuse victims.

Google says the alert is designed to disrupt social-engineering attacks—where fraudsters keep talking nonstop to prevent the user from thinking clearly.

‘30-Second Safety Break’: Google’s Smartest Anti-Scam Weapon

One of the biggest additions is the mandatory 30-second pause period.

●During these 30 seconds, users:

●Cannot proceed with risky actions

●Are encouraged to rethink their next step

●Get time to break free from the scammer’s pressure tactics

According to Google, this brief pause significantly lowers the chances of victims sharing OTPs or screen access under stress.

UK Pilot Project Saved Thousands from Fraud

The upgraded feature was first tested in the UK earlier this year. Results were dramatic:

●Thousands of users avoided suspected scam calls

●Multiple cases were prevented where users were moments away from revealing sensitive details

●Alerts helped stop screen-sharing traps, the fastest-growing scam method

Google says the UK pilot’s success proved that timely, intelligent alerts can stop high-risk fraud attempts in real-time.

India and Brazil Pilots Successful — Wider Rollout Expected Soon

Given India’s massive digital payments ecosystem and rising cybercrime, Google also tested the feature in India and Brazil.

Both countries saw strong positive outcomes, with many users avoiding financial losses.

Google is now expanding support in the UK across major banks and financial platforms—and a wider rollout for India is expected in the coming phases.

Why This Feature Is Crucial for India

Digital payments in India are booming—but so are scams. Fraudsters routinely:

●Pretend to be bank officials

●Pressure users to screen-share

●Ask them to open UPI apps during calls

●Steal passwords, OTPs, and account access

Google’s upgraded system attacks this model head-on by intervening at the exact moment danger begins.

A New Protective Layer for Every Android User

Google’s In-Call Protection is more than a warning—it’s a real-time decision-support system that prevents users from making rushed, harmful choices.

As digital payments continue to grow, this feature is being seen as one of the most meaningful advancements in mobile cyber safety.