Every time you apply for a loan or credit card, the first thing banks check is not your salary slip — it’s your CIBIL Score. This three-digit number decides whether you’ll get that dream home loan easily or face rejection.

But how does this mysterious score come to life? What exactly affects it? Here’s a deep dive into the CIBIL formula that determines your financial credibility.

What Is a CIBIL Score?

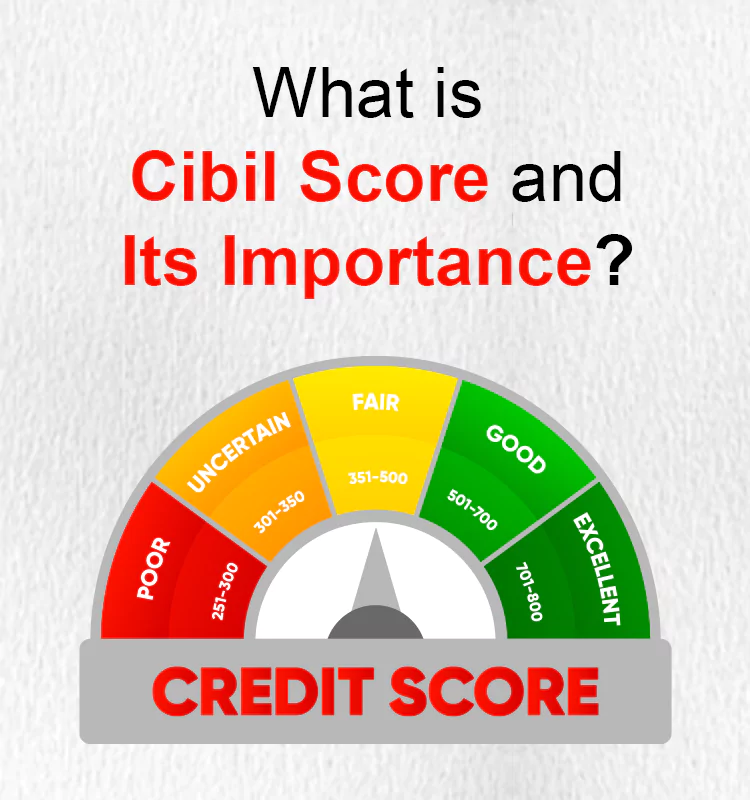

The CIBIL Score — ranging from 300 to 900 — is India’s most trusted measure of your creditworthiness.

A score of 750 or above is considered excellent.

It tells banks how disciplined you are with your money — whether you pay bills on time, borrow responsibly, and manage debt smartly.

In short, your CIBIL Score is your financial report card. A good score gets you faster approvals and lower interest rates; a poor one can make lenders wary.

4 Key Factors That Decide Your CIBIL Score

The Credit Information Bureau of India (CIBIL) calculates this score based on four major components — each with a specific weightage.

1. Payment History – 30%

Your repayment record matters the most.

Timely EMI and credit card payments boost your score.

Delayed or missed payments leave a permanent scar on your credit profile.

Tip: Automate your EMI payments to never miss a due date.

2. Credit Exposure – 25%

Also known as credit utilization, this checks how much of your credit limit you’re using.

Using more than 30% of your total limit signals over-dependence on credit.

Keeping usage low shows financial discipline and boosts your score.

3. Credit Mix & Duration – 25%

Lenders prefer borrowers who have a healthy mix of both secured (home, car) and unsecured (credit card, personal) loans.

A longer credit history helps build credibility.

Constantly closing old accounts may reduce your average credit age, lowering your score.

4. Recent Credit Behavior – 20%

Multiple loan or credit card applications within a short period can harm your score.

It signals “credit hunger” — a red flag for lenders.

Limit new applications and maintain a stable credit pattern.

5 Simple Ways to Improve Your CIBIL Score

1. Pay EMIs and bills before the due date.

2. Keep credit card usage below 30%.

3. Avoid frequent loan applications.

4. Maintain old accounts to show long credit history.

5. Regularly check your CIBIL report for errors or fraudulent entries.

Why It Matters

Your CIBIL Score isn’t just a number — it’s your financial identity.

A strong score helps you:

●Get loans faster

●Negotiate lower interest rates

●Build long-term trust with banks

So next time you apply for a loan and the officer smiles saying,

“Your CIBIL score speaks for itself,”

you’ll know — it’s because of your smart financial habits.