In a historic judgment that could reshape the legal and financial landscape of India’s digital economy, the Madras High Court has ruled that cryptocurrencies are “property,” not currency, under Indian law.

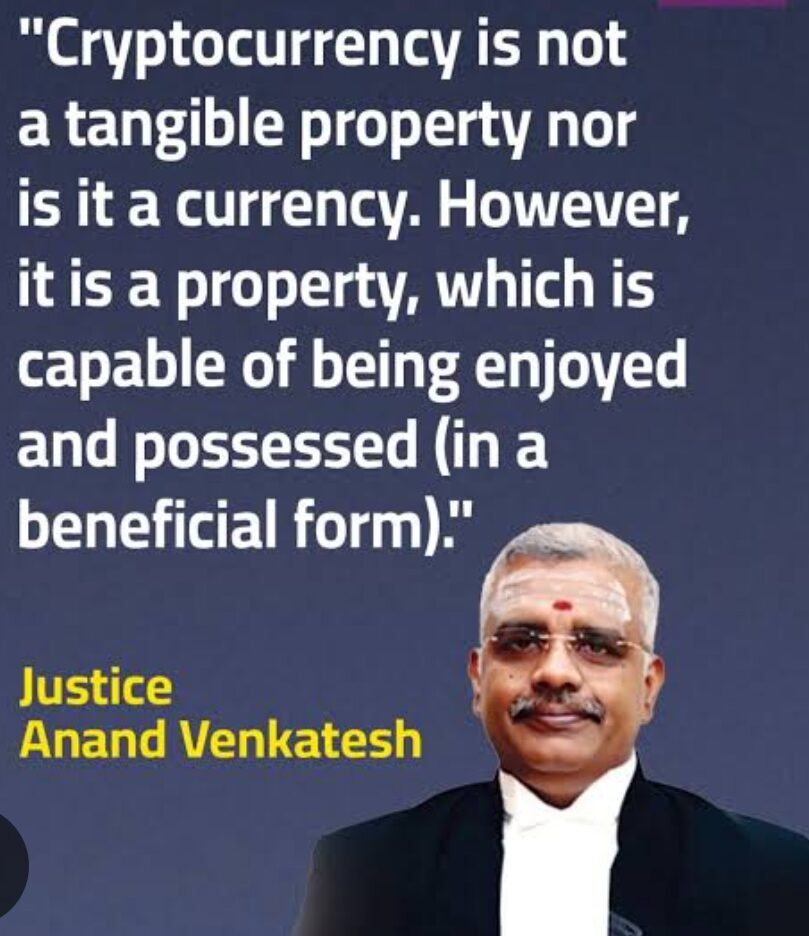

Delivering the pathbreaking verdict, Justice N. Anand Venkatesh observed that while cryptocurrencies like XRP are not legal tender, they undeniably possess the core attributes of property— capable of being owned, transferred, and even held in trust.

“It is not a tangible property nor is it a currency. However, it is a property, capable of being enjoyed and possessed… capable of being held in trust,” the Court stated.

This declaration places digital assets within a clear legal framework, giving investors long-awaited judicial clarity and setting a precedent that may influence the upcoming Digital India Act and future crypto legislation.

Investor’s Case Sparks a National Debate

The ruling came in response to a petition by a Chennai-based investor whose 3,532.30 XRP tokens (worth ₹1.98 lakh) were frozen following the July 2024 WazirX hack, one of India’s biggest cyberattacks.

The hack targeted Ethereum and ERC-20 tokens, causing losses exceeding $230 million (Rs1,900 crore) and prompting mass account freezes. The petitioner argued that her XRP tokens were unrelated to the compromised assets and should not be included in the freeze.

Invoking Section 9 of the Arbitration and Conciliation Act, 1996, she sought the court’s protection against Zanmai Labs Pvt. Ltd., the Indian operator of WazirX, demanding her rightful access to her assets.

Exchange’s Defense Dismissed — Court Asserts Jurisdiction

Zanmai Labs contended that its Singapore-based parent company, Zettai Pte Ltd, was under court-directed restructuring and that all users were required to share collective losses.

Justice Venkatesh rejected this argument outright, ruling that the petitioner’s holdings were distinct from the hacked ERC-20 tokens, and thus could not be withheld.

“What were subjected to the cyberattack were ERC-20 coins, which are completely different cryptocurrencies not held by the applicant,” the Court clarified.

Citing the Supreme Court’s 2021 ruling in PASL Wind Solutions v. GE Power Conversion India, the Madras High Court affirmed that Indian courts retain full jurisdiction over assets within Indian territory, even amid international legal proceedings.

Recognition Under the Income Tax Act Strengthens Legal Standing

In a key development, the Court referenced Section 2(47A) of the Income Tax Act, which defines cryptocurrencies as Virtual Digital Assets (VDAs). Justice Venkatesh explained that this classification grants cryptocurrencies a statutory identity as property, capable of being taxed, owned, transferred, and even inherited.

This interpretation effectively provides legal ownership rights to investors—something India’s crypto sector has long lacked—cementing the judiciary’s role in legitimizing digital assets.

Call for Stricter Crypto Oversight

Justice Venkatesh’s verdict also urged policymakers to adopt a robust regulatory mechanism for crypto exchanges. The Court recommended:

●Independent third-party audits of all exchanges,

●Clear separation of client and corporate funds, and

●Strengthened KYC and AML protocols to safeguard investor funds.

He emphasized that India’s transition toward a Web3-driven digital economy demands accountability and transparency at every level.

Implications for India’s Crypto Ecosystem

Legal experts hailed the ruling as a turning point for India’s fintech and blockchain sectors.

“This judgment bridges a crucial gap in India’s legal understanding of digital assets. It not only secures investor rights but also nudges the government toward creating a structured regulatory framework,” said a senior corporate lawyer specializing in digital finance.

The verdict is expected to influence discussions around the Digital India Act and the Virtual Digital Assets Taxation policy, both of which will define India’s crypto future.

A Step Toward Legal Maturity in the Digital Age

By acknowledging cryptocurrency as property, the Madras High Court has aligned India with global legal trends, where nations like the UK, Singapore, and Japan already recognize crypto assets under property law.

The judgment represents not just a victory for one investor—but a milestone for India’s legal evolution in the age of digital finance.

It ensures that cryptocurrencies are not seen as mere code or speculative assets but as legally protected forms of property—paving the way for greater innovation, investor confidence, and economic modernization.

In Essence:

The Madras High Court’s ruling isn’t just a legal milestone—it’s the foundation of India’s crypto future, where technology, finance, and law finally converge.