In a sweeping push to restore consumer trust in India’s financial system, the Reserve Bank of India (RBI) has announced an aggressive two-month crackdown to clear all long-pending complaints against banks and NBFCs. The special initiative — internally called “Operation Clean Complaints” — will run from January to February 2026 and aims to ensure no grievance remains unresolved beyond 30 days.

The RBI said the campaign will reinforce transparency, accountability, and customer-first governance across regulated entities, marking one of the most decisive consumer protection moves in recent years.

Surge in Complaints Triggers Action

India’s financial sector has seen an explosion in grievance filings.

According to RBI data:

●13.34 lakh complaints were registered in FY 2024–25 — a 13.55% surge.

●Loans & advances accounted for 29.25% of all complaints.

●81.53% of complaints were against banks, 14.80% against NBFCs.

●Digital banking complaints dipped slightly but remain significant.

Though most complaints are resolved within deadlines, the massive inflow has caused unprecedented backlogs, prompting this urgent intervention.

RBI Ombudsman: India’s Consumer Shield

Under the Integrated Ombudsman Scheme, customers can report:

●Unauthorized or excessive charges

●Mis-selling or billing disputes

●Failed digital transactions

●Poor or delayed customer service

But rising frauds, payment failures, and service lapses have stretched the system, leaving thousands waiting weeks — even months — for closure.

Operation Clean Complaints: What RBI Has Ordered

From January 1 to February 28, 2026, all banks and NBFCs must:

●Identify every complaint pending beyond 30 days

●Resolve them on priority with fair, time-bound action

●Strengthen internal grievance teams to prevent future delays

●Improve consumer communication and response quality

The RBI will review progress weekly and publish transparency reports.

Governor’s Message: “Delays Are Not Acceptable”

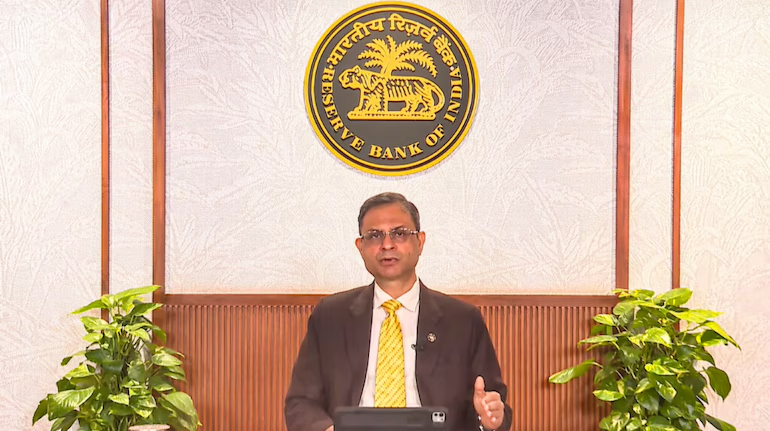

RBI Governor Sanjay Malhotra delivered a strong warning:

“Timely resolution of complaints is the backbone of trust in financial services. India’s banking system must evolve from compliance-driven to customer-driven operations.”

He added that publishing monthly pending-complaint reports is part of a larger effort to make the system open, accountable, and trustworthy.

Why This Mission Matters

India’s rapid digitalisation — UPI, online lending, fintech apps — has also led to:

●An increase in fraud and failed transactions

●Unauthorized debit issues

●Fake lending apps

●Service lapses by regulated & unregulated players

Unresolved grievances create frustration and erode public trust — something the RBI is determined to reverse.

A Reset Moment for India’s Banking System

For millions of customers, this campaign promises long-awaited relief.

For financial institutions, it is a clear message:

Customer experience is no longer optional — it is the foundation of India’s financial stability.

As the RBI noted:

“Every customer matters — big or small. Their time and trust are the heart of India’s financial ecosystem.”