Many people believe that once their CIBIL score drops, it becomes impossible to recover. The fear of loan rejections, credit card denials, and financial stress often makes the situation feel worse. But financial experts say that a low credit score is not permanent—it can be rebuilt with steady and disciplined effort.

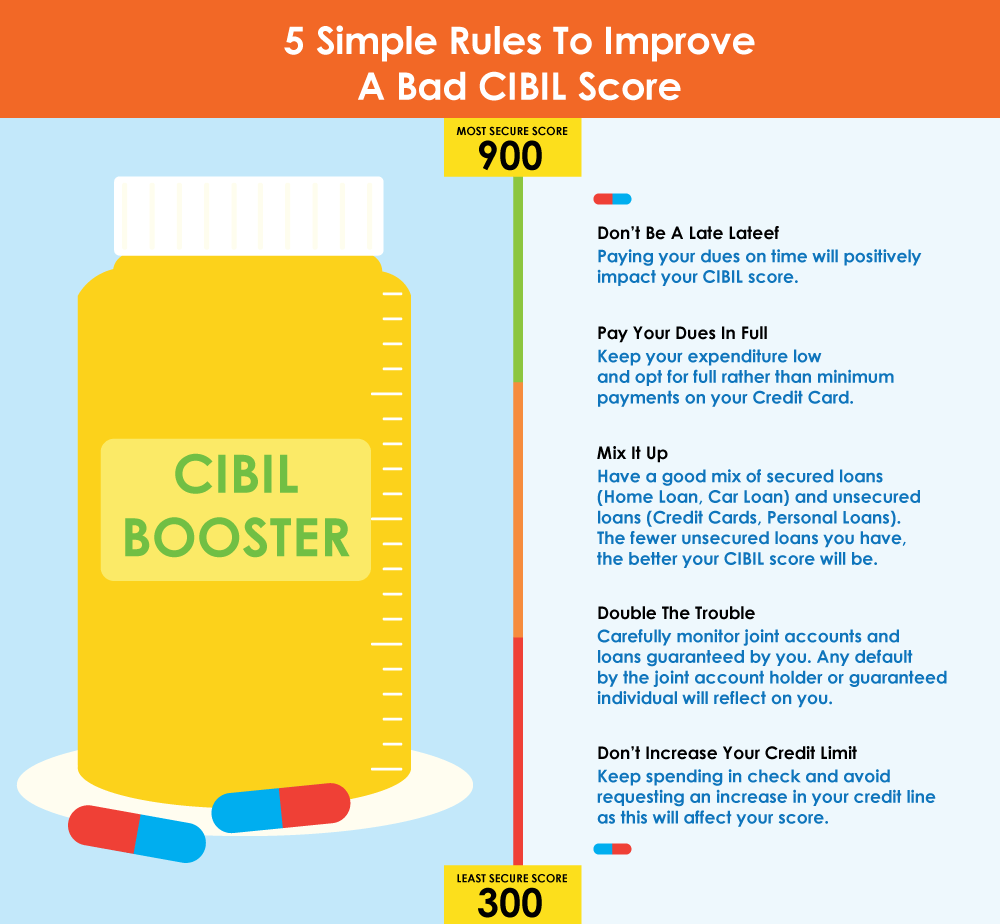

A CIBIL score is a three-digit number between 300 and 900 that reflects your history of loan repayments and credit card usage. A score above 650-700 is considered good, while anything below that signals the need for improvement. A higher score can help you get lower interest rates, higher credit limits, and quicker loan approvals.

Why Scores Drop

●Most people see their score fall because of:

●Missing EMIs or credit card payments

●Overspending on credit cards

●Keeping high outstanding balances

●Applying for multiple loans frequently

●Not monitoring credit reports for errors

However, with consistent steps taken over a few months, your score can start rising again.

Steps To Improve CIBIL Score

1. Clear Outstanding Dues First

If you have overdue payments, make them your first priority. If handling multiple loans feels difficult, consider consolidating loans into one to simplify repayment.

2. Keep EMIs Within 30% of Your Monthly Income

Experts recommend that your total EMIs should not exceed 30% of your take-home salary. This shows lenders that you are financially stable and manage repayment responsibly.

3. Use Credit Cards Wisely

Avoid maxing out your credit card. Try to keep usage under 40% of the credit limit. Pay your full bill before the due date — not just the minimum amount.

4. Maintain a Mix of Secured and Unsecured Loans

A home or gold loan (secured) along with a credit card or personal loan (unsecured) shows balanced credit behaviour. This helps build lender trust.

5. Monitor Your CIBIL Report Regularly

Sometimes the score drops due to errors in the report. Regular check-ups help you dispute incorrect entries and track improvement.

Why This Matters

Your CIBIL score plays a major role in shaping your financial opportunities. Improving it now can ensure:

◆Lower interest on home, car, and personal loans

◆Easy approval for future credit

◆Better financial confidence and stability

With just a few months left in the year, consistent financial discipline can help you rebuild your score and move closer to your financial goals.